January 2017

In this article, Enrique Garza of Garza Tello & Associates and Lewis McDonald of Skuld outline the new insurance regulations recently introduced in Mexico and how they affect insurance requirements in the country.

Mexico is one of the largest oil producers in the world and the offshore industry is crucial to the country's economy. Many of our assureds operate in the region and, as with every region, offshore Mexico offers its own unique challenges. Last year, new regulations were introduced by Mexico's National Agency for Industrial Safety and Environmental Protection in the Oil Industry (ASEA) which set out minimum limits for many insurances, including P&I cover.

The limits introduced by these new regulations could have an effect on our assureds, particularly for those under the MOU P&I programme where fixed insurance limits are purchased. With the traditional P&I insurance renewal season approaching, for those operating in Mexico, and those potentially considering operations there, it is worth looking at what these new limits are and to consider what that means in relation to the insurance covers you have in place.

The new regulations

During 2016, new insurance rules came into play for those operating in the oil and gas industry offshore Mexico. On 23 June 2016, ASEA issued new regulations which establish a minimum insurance requirement for companies directly performing activities or construction works relating to oil exploration and production, petroleum processing and refining, and processing of natural gas.

These regulations set out that mandatory insurance coverage for:

- civil liability

- environmental damage liability

- when applicable, well control

needs to be put in place by offshore companies.

The limits for civil liability and environmental damage are determined either through a Regulatory Minimum insured sum or through a Probable Maximum Loss (PML) study carried out in accordance with ASEA rules.

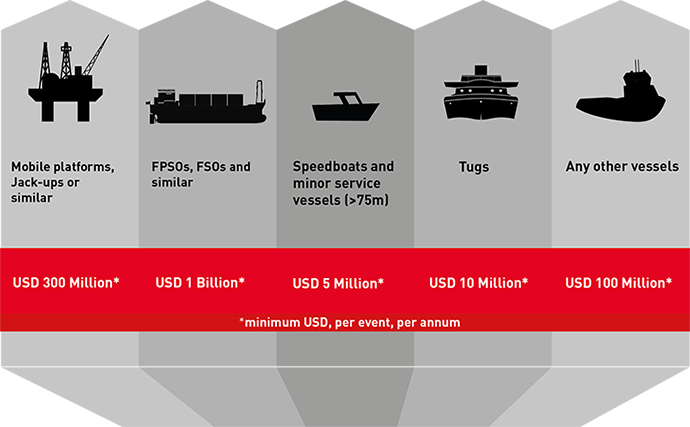

In addition, offshore companies using vessels or mobile platforms for exploration and production, petroleum processing and refining, and processing of natural gas must obtain their P&I insurance from underwriters authorised by the Mexican Finance Ministry in compliance with the minimum insured sums set out under the Regulations and must be valid for one year:

In terms of the regulations, it is prohibited for the policies to include any conditions precedent in relation to time limits and insurance companies must also expressly waive any subrogation rights against the Mexican government, stating that under no circumstance shall the insurers submit a claim against the Mexican government. It is also worth bearing in mind that, in terms of the regulations, the insurance covers taken out may not be reduced to the prejudice of the Mexican nation nor by virtue of any agreement between oil majors and their contractors.

Requirement to ensure that all parties maintain valid insurance

From an operational perspective, offshore companies should note that under the regulations they are required to ensure that their contractors, sub-contractors and suppliers all maintain valid insurance policies with the necessary coverage to insure any damages that might be caused as a result of the works, services and/or activities that they carry out. It is important to note however that the insurances obtained by the contractors, subcontractors and suppliers do not need to be placed through a Mexican insurance company. As an alternative, offshore companies could, subject to underwriter approval, consider including their contractors and suppliers in their own policies.

Skuld is authorised to write reinsurance business in Mexico

Skuld holds the required reinsurance authorisation from the Mexican authorities to write business in the country. Please contact one of our underwriters to discuss any new or existing arrangements, and, if necessary, evaluate whether new limits are required.